The Unknown Costs of a “Nothing-Burger”

Randall Bartlett

At first blush, Budget 2018 would have seemed like a “nothing-burger” budget, if judged by the change in the budget balance alone. But scratch beneath the surface, and the overly optimistic revenue forecasts and unrealistic savings that made room for new spending announcements quickly become apparent. How did these forecast changes come about? It’s tough to tell without sufficient transparency around the numbers for parliamentarians to hold the government to account.

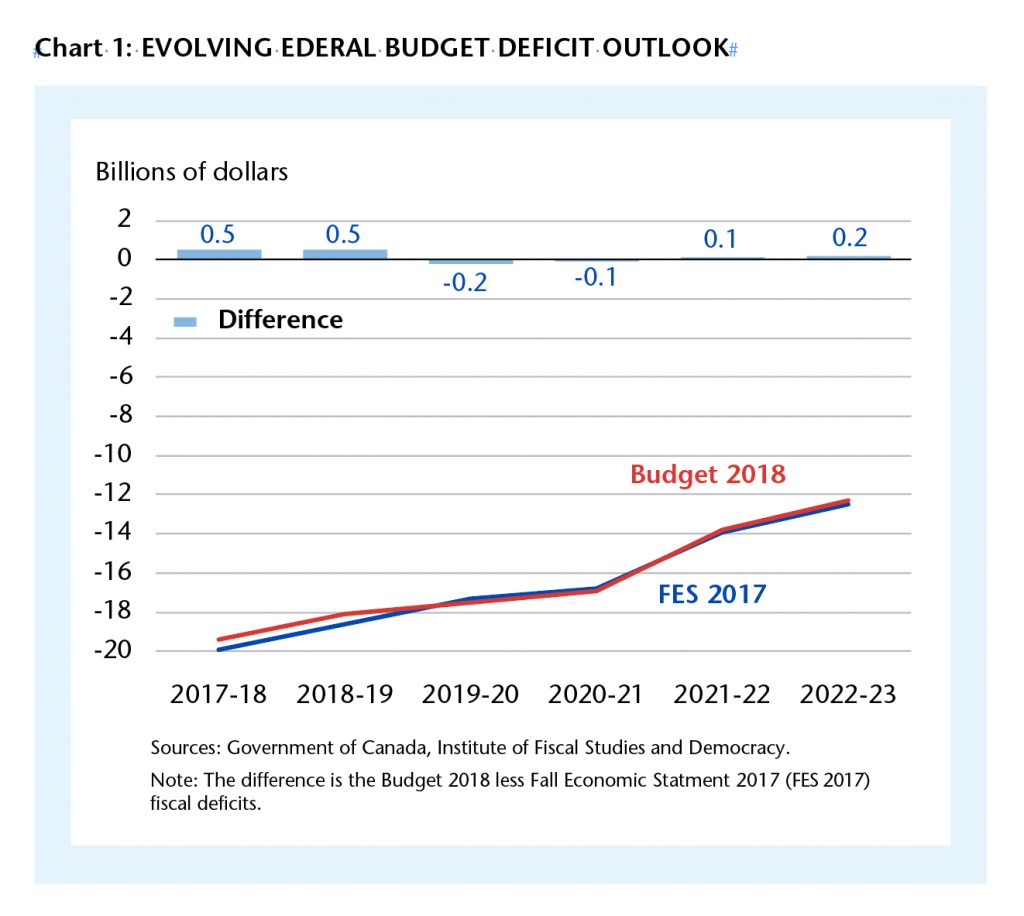

For a lot of commentators, a first glance at the revised outlook for deficits in Budget 2018 suggested it was a bit of a “nothing-burger” budget. This is because the federal government’s forecast for persistent fiscal holes remained essentially unchanged relative to the Fall Economic Statement 2017 (FES 2017), with an average annual improvement in the deficit of less than $0.2 billion over the next five years (Chart 1). And given that the economic outlook was also broadly unchanged from the fall of 2017, it would be tough to blame someone for their first reaction having been to shrug.

However, that initial impression could not have been more wrong. Indeed, the fact that the budgetary deficits looked so similar to those in the FES 2017 was the first hint that something could be amiss. This includes overly optimistic revenue and spending forecasts, which leave the federal government vulnerable to significant risks that deficits may be much larger going into the 2019 election than it currently anticipates.

However, that initial impression could not have been more wrong. Indeed, the fact that the budgetary deficits looked so similar to those in the FES 2017 was the first hint that something could be amiss. This includes overly optimistic revenue and spending forecasts, which leave the federal government vulnerable to significant risks that deficits may be much larger going into the 2019 election than it currently anticipates.

Mo’ money, mo’ problems (understanding where it came from).

The starting point for understanding the federal budget is always the economy. In the past, the current and former governments have used swings in the economy to justify additional spending and/or fiscal austerity, depending on the stage of the electoral cycle and the reigning narrative of the day.

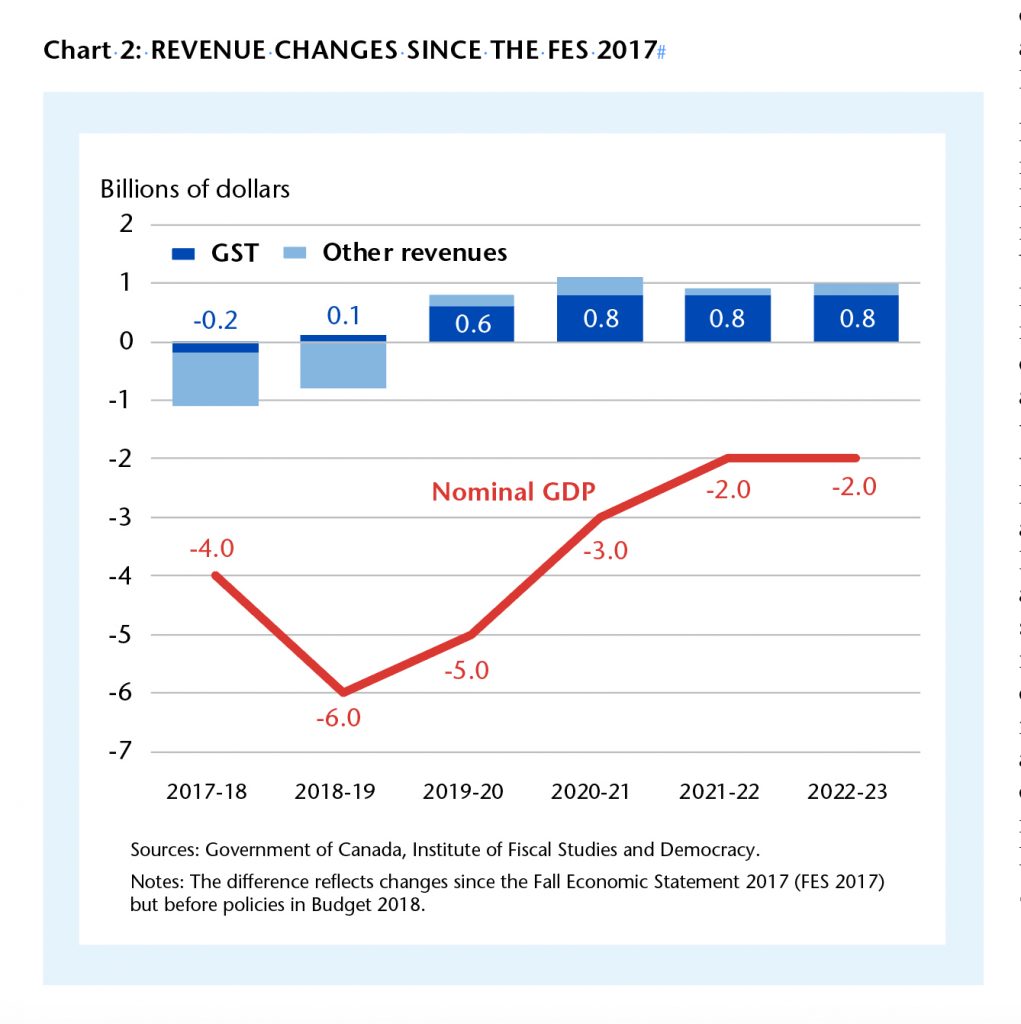

In Budget 2018, there wasn’t much to talk about on the economic front. Nominal GDP—the broadest measure of the tax base—came in an average of $4 billion lower in every of the forecast than in the FES 2017. Typically, this would translate into lower average revenues of about $600 million annually.

In contrast, the federal government is forecasting that revenues will be higher by an average of over $300 million in every year of the forecast before any of the new measures from Budget 2018 are accounted for. In the near term, “Other revenues” have come in much weaker than expected at the time of the FES 2017, and this trend is expected to continue into the coming fiscal year. Employment Insurance (EI) premium revenues are also expected to come in modestly lower over the course of the forecast, although this is projected to be offset by an upwardly revised forecast for income taxes. And while one can quibble over these outlooks, these differences are the stuff of debate among a few specialists but are clearly tied to changes in the economic look and minor changes in policy between the FES 2017 and Budget 2018.

Where the differences between the federal government’s outlook for revenues in Budget 2018 really jumps out when compared to the FES 2017 is in “Excise taxes/duties”. Indeed, the federal government is projecting that the tax take in this revenue category will be about $0.8 billion higher on average in every fiscal year from 2017-18 through 2021-22 before even accounting for Budget 2018 measures.

So, what’s driving this increase? The higher excise taxes/duties since FES 2017 can largely be chalked up to stronger growth in the taxable consumption base pushing up the GST. However, since the federal government does not publish its outlook for taxable consumption, there is no way to critique its forecast. This lack of transparency in the federal government’s economic forecast means it’s hard to verify whether or not it’s credible. But just taking a quick look at the change in projected GST revenues makes clear that consumers are expected to spend a much larger share of a falling income base going forward (Chart 2). And this at a time when Canadian households are holding record levels of debt and interest rates are on the rise—two downside risks to the economic outlook highlighted in Budget 2018 as well as by the Bank of Canada. This new-found GST revenue is anywhere from 60 per cent to 80 per cent of the change in the government’s pre-budget tax take. So, in regard to the GST revenue forecast, something doesn’t smell quite right.

Beyond the head-scratching increase in GST revenues and other excise taxes that seem to be moving the opposite direction of the economy, Budget 2018 also introduced some new excise tax measures that kept revenues still smoking. These were higher taxes on sales of tobacco and legal cannabis, which are expected to add a respective annual average of about $300 million and $150 million to revenues starting in the 2018-19 fiscal year. And, in the case of legal cannabis revenues, this is only 25 per cent of the estimated total revenues, with the remainder going to the provinces and territories. But these ‘sin taxes’ won’t be enough to offset the drop-in tariff revenues associated with Canada entering the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), which will see revenues fall by over $500 million annually starting in fiscal 2019-20.

Fortunately for the feds, higher revenues from taxing income on private investments inside a private corporation and closing tax loopholes are expected to rake in about $800 annually starting next year, split roughly evenly between the two. However, as we’ve seen with other income tax measures introduced by this government, their assumptions may turn out to be optimistic as people and companies choose to change their behaviour to avoid paying these new taxes. As a result, when combined with the rosy outlook for excise taxes, it is difficult for one to conclude anything other than the federal government’s revenue forecast is high on optimism.

Fortunately for the feds, higher revenues from taxing income on private investments inside a private corporation and closing tax loopholes are expected to rake in about $800 annually starting next year, split roughly evenly between the two. However, as we’ve seen with other income tax measures introduced by this government, their assumptions may turn out to be optimistic as people and companies choose to change their behaviour to avoid paying these new taxes. As a result, when combined with the rosy outlook for excise taxes, it is difficult for one to conclude anything other than the federal government’s revenue forecast is high on optimism.

Big talk on spending, but the talk has been cheap

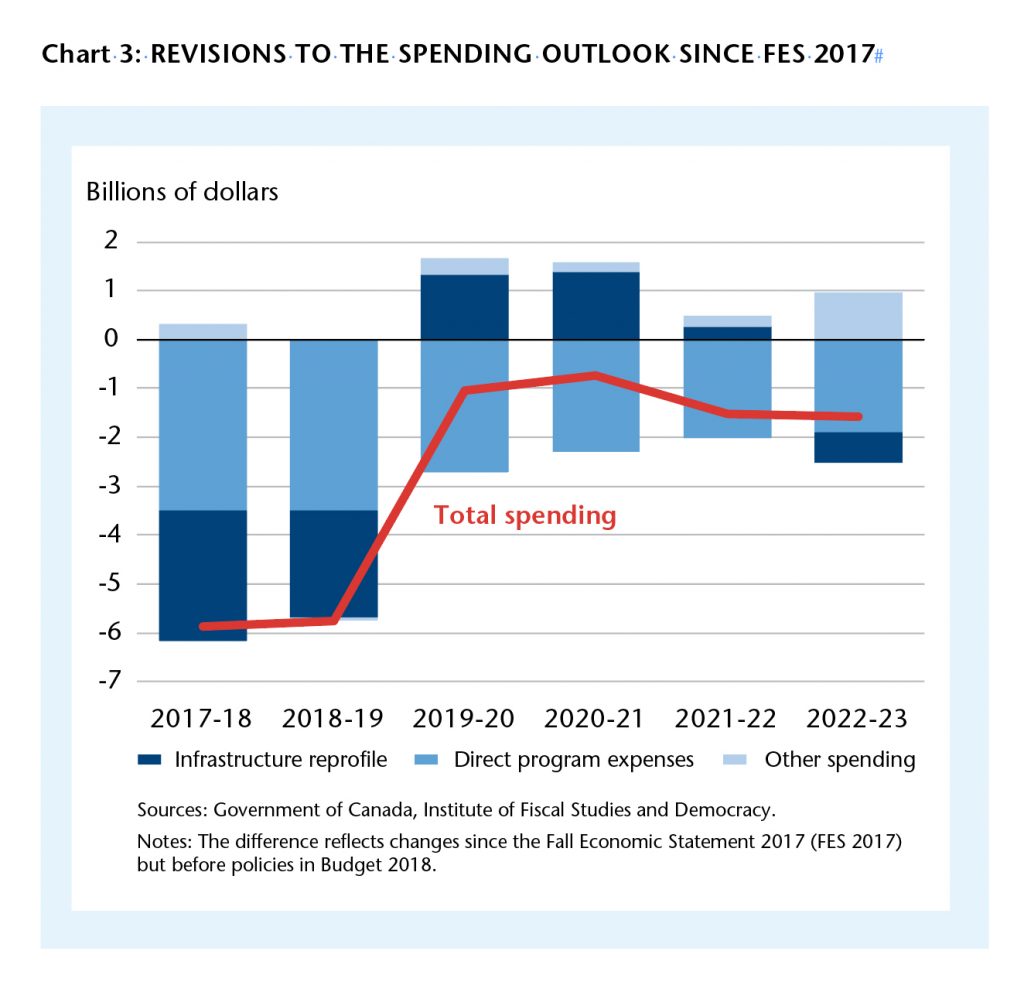

Call it a mid-mandate miracle. Between the FES 2017 and Budget 2018, the federal government managed to not only find some revenue windfall but also managed to save some money on the spending side. Indeed, Direct Program Expenses (DPE)—the discretionary part of the federal fiscal framework—is now expected to total nearly $16 billion less, or $2.7 billion lower annually, from the 2017-18 through 2022-23 fiscal years (Chart 3). In the first couple of years of the outlook, the lion’s share of these savings is expected to come from infrastructure money left unspent, which is estimated to come in at about $2.4 billion lower in fiscal 2017-18 and 2018-19 than was projected in the FES 2017. The remainder of the savings are said to come from lower projected departmental spending. While the explanations are plausible in the 2017-18 and 2018-19 fiscal years, swallowing the story of a dramatically lower outlook for non-infrastructure DPE in the outer years requires a significant leap of faith. This is particularly striking when you consider that the downward revisions in spending in Chart 3 don’t include any new measures from Budget 2018.

As a result of this expanded fiscal space thanks to a much lower spending track than was expected in FES 2017, there was plenty of room created to shrink the deficit over the next few years. But deficits are not a concern for the current government. Instead, all of the savings freed up resources that were allocated to $21.5 billion in new policy measures. These were organized into vaguely named groups such as “Progress” and “Advancement”, which more closely resemble the names of men’s deodorant scents than buckets of fiscal outlays.

For the 2017-18 fiscal year, the big new spending measure was the “Pension for Life” plan, which will provide monthly, tax-free payments for life for veterans who experience a service-related injury or illness. This equated to a lump-sum expense of $4.2 billion up front, but will result in annual savings over nearly $100 million now and increasing over the long term. Other spending measures to be lumped into fiscal 2017-18 include $600 million for disability/employee benefits plans for members of the Canadian Armed forces and public servants, as well as an additional $1.4 billion for “non-announced measures”. All in, new spending totalled $6.3 billion in the current fiscal year.

The remainder of the $15.2 billion in new measures announced in Budget 2018 for the remaining five years of the forecast were targeted toward meeting the health, family and other needs of Canada’s Indigenous peoples ($4.1 billion), innovation, skills and science ($6.4 billion), and trade, labour and income taxes (-$1.0 billion, thanks to higher income taxes), with the remaining $6.2 billion herded into the catch-all categories “Advancement” and “Other Budget 2018 investments”. Notably, what was not in Budget 2018 was a costing of the measures announced to achieve greater gender parity in the federal sector, particularly as it pertains to earnings.

Taken together, while the headline budget deficit numbers were nothing to write home about, important questions remain. For instance, given the weaker economic outlook, why the optimism on revenues? Where did all of the savings come from for DPE, and are these sustainable? Against the backdrop of an economy that is essentially as good as it gets, both of these outlooks seem overly optimistic. And without transparency around the details of how these forecasts were reached, one cannot say with confidence that they are credible.

Parliamentarians need and deserve this information around taxing and spending to hold the government to account. Without it, they can’t fulfill their constitutional obligations.

Randall Bartlett is Chief Economist of the Institute for Fiscal Studies and Democracy at the University of Ottawa. randall.bartlett@ifsd.ca