A Fiscal Policy Perspective on Budget 2018: Is it Credible? Is it Accountable?

Kevin Page and Salma Mohamed

As the Parliamentary Budget Officer, Kevin Page developed a national reputation for holding the previous government accountable. In his current role as president of the Institute for Fiscal Studies and Democracy at the University of Ottawa, Page says Bill Morneau deserves credit for the 2018 budget, with a couple of serious asterisks. Here’s his assessment, with an assist from University of Ottawa student Salma Mohamed.

Samuel Adams, the American founding father and philosopher, coined the phrase “give credit to whom credit is due”. Finance Minister Bill Morneau deserves credit. When the Liberals won the fall 2015 election, the economy was hurting. There was no economic growth. The unemployment rate stood above

7 per cent. Much has changed since 2015 and much is good.

On February 27, Morneau tabled his third budget. It must have felt like getting to the top of a large hill. As he stood in the House of Commons to deliver his speech, the year-over-year growth in GDP stood above 3 per cent and the unemployment rate below 6 per cent. Many economic indicators are moving in the right direction. Growth is now balanced between the goods and services sector. Investment in machinery and equipment and wages are moving on up. The employment rate is finally trending up after years of resting in the doldrums since the 2008 financial crisis.

“Give credit to whom credit is due”. The government said they would run modest deficits on the backs of significant expenditures that would support the “middle class” and public infrastructure. They did all of this. Growth in consumption and public investment have contributed to overall economic growth.

Nelson Mandela, the late South African leader said he “discovered the secret that after climbing a great hill, one only finds that there are more hills to climb.” While it is important to enjoy the vista and reflect on the journey, Mandela cautioned that “the long walk is not ended.” For Morneau and the Liberal government, their long walk will be to the federal election October, 2019.

The economic and fiscal environment in 2018 is very different than 2015. Risks are evolving. After three federal budgets, it would seem to be a fair question to ask whether the government’s fiscal policy is credible looking forward, not through a rearview mirror. How might Canadians hold the government accountable from a fiscal policy perspective in the next federal election?

Budgets are first and foremost supposed to be fiscal planning documents. Parliamentarians and Canadians need to know what is the fiscal plan to move forward on the government’s policy priorities given the state of the economy and the nation’s finances, the outlook and related risks. Fiscal policy relates to how the government will adjust spending and taxation to influence the economy.

We have a $2.2 trillion economy. Total federal budgetary revenues and expenditures exceed $300 billion. The government has heft. How the government allocates its tax resources or whether it runs a surplus or deficit impacts economic growth rates and the standard of living of Canadians.

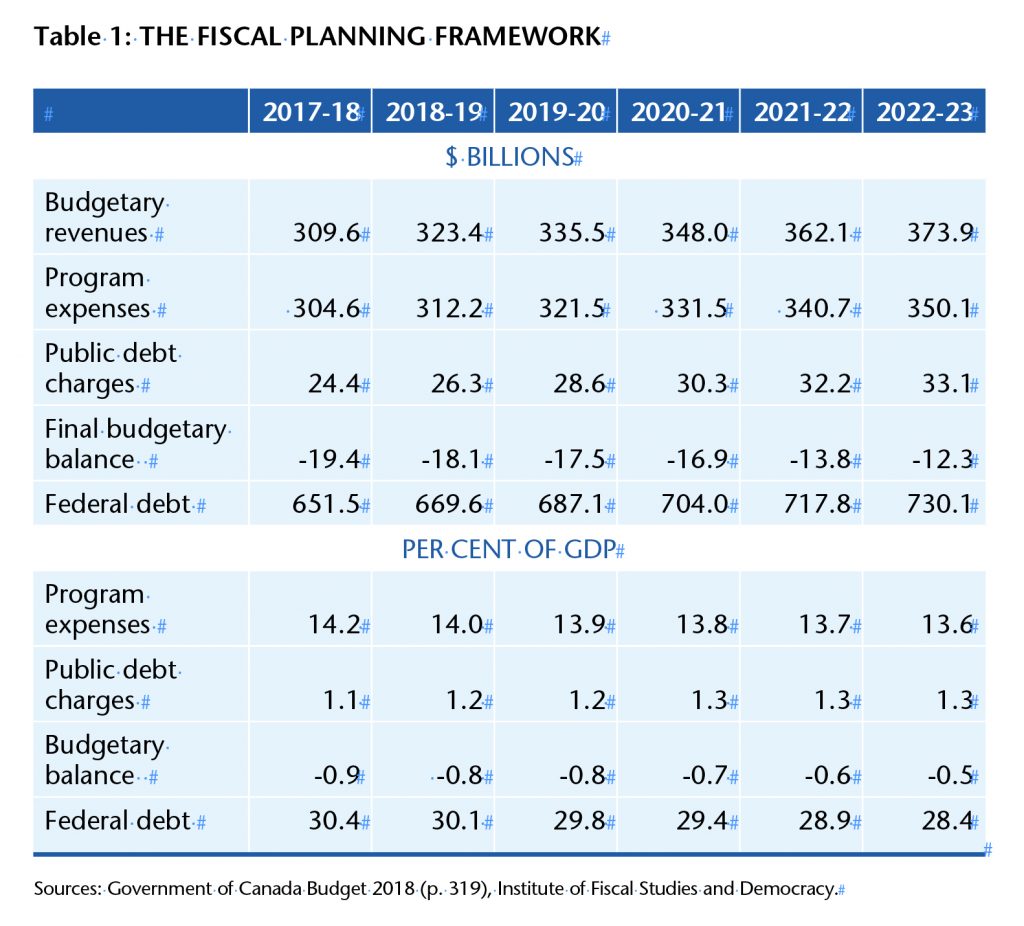

In the context of a strong economy, Budget 2018 laid out a fiscal track that was virtually identical to the one Morneau presented in his Fall 2017 Update. The budgetary deficit is projected to decline from just under $20 billion in 2018-19 to just over $12 billion (Table 1 next page). As a percentage of the economy (GDP), the deficit falls from 0.9 per cent to 0.5 per cent over this period.

At this juncture, it looks like this is the fiscal track the government is prepared, and hopes, to take into the next election.

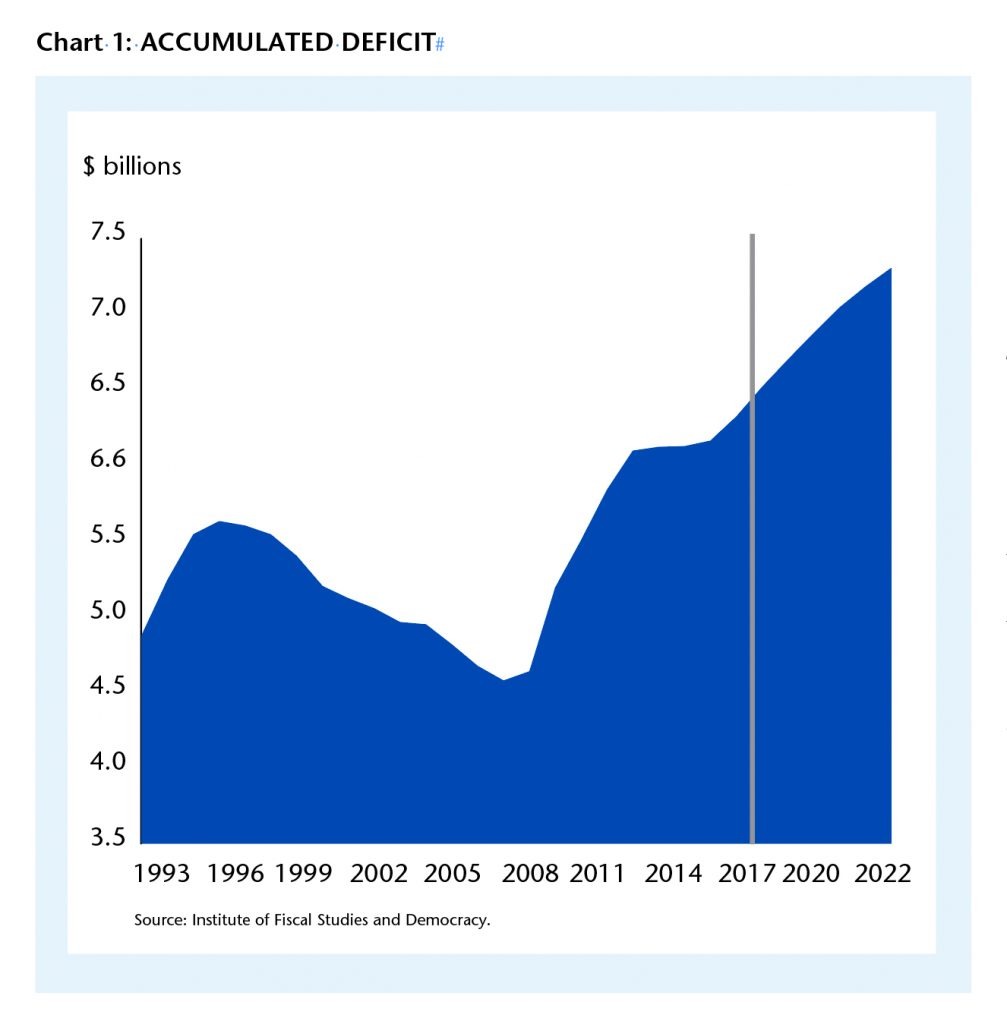

When one adds up the deficits generated by the liberal government over the planning period it is equivalent to $115 billion—a 19 per cent increase in the federal debt since 2015-16. The trend of rising federal debt continues since the impact of the 2008 financial crisis (Chart 1). It is a large increase in nominal terms.

When one adds up the deficits generated by the liberal government over the planning period it is equivalent to $115 billion—a 19 per cent increase in the federal debt since 2015-16. The trend of rising federal debt continues since the impact of the 2008 financial crisis (Chart 1). It is a large increase in nominal terms.

As a percentage of GDP, if we assume continuous growth over the next five years (i.e., the economy operates at or above its potential), federal debt declines from 31 per cent in 2015-16 to about 28 per cent in 2022-23 (Table 1). So, planned debt would remain relatively modest in historic terms and compares favourably with other Organization for Economic Cooperation and Development (OECD) countries, as pointed out in federal documents.

For economists, the federal budget deficit is relatively small and structural in nature. It is small with regard to the larger budgetary deficits generated in the 1980s-90s. It is structural in the sense that the government is aware that it will have to raise taxes or reduce spending to eliminate the deficit. Hey, we are running a deficit and the economy is strong.

The modest decline in the budgetary deficit over the next five years reflects a reduction in spending growth relative to the size of the economy. Revenues keep pace with the economy. It may surprise some budget watchers that the Liberal government is “planning” to use the brake pedals to spending in the years ahead (Table 1).

Analysis by the Parliamentary Budget Office and the Institute for Fiscal Studies and Democracy indicates that the current federal fiscal structure is sustainable in the sense that it should not lead to rising debt-to-GDP ratios over the long run in the face of aging demographics. This is important but the analysis needs to be updated when the government makes commitments related to new initiatives like pharmacare or a national defence strategy.

Budget 2018 allocated $21.5 billion in new measures over a five-year period. These measures were financed by re-allocations or savings from the planned spending framework that were not specifically identified—although we know it comes from direct program spending (i.e., voted appropriations related to grants and contributions, capital and operations).

Budget 2018 allocated $21.5 billion in new measures over a five-year period. These measures were financed by re-allocations or savings from the planned spending framework that were not specifically identified—although we know it comes from direct program spending (i.e., voted appropriations related to grants and contributions, capital and operations).

What is of note is that the government did not want to raise the deficit track to move forward on Budget 2018 initiatives.

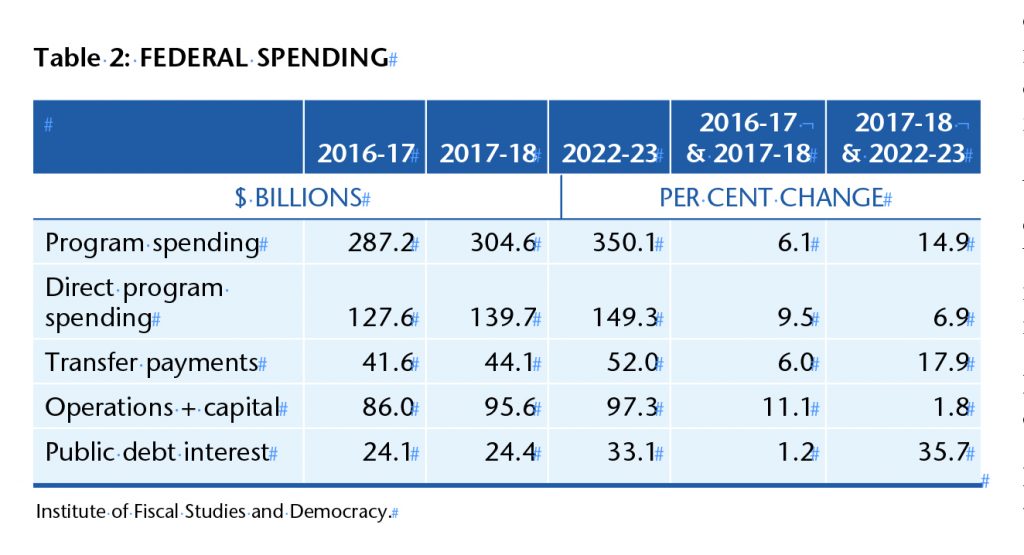

What is also of note is that the government believes it can find savings for the new initiatives from spending components that are growing the least over the planning period (Table 2).

There are more than a 100 spending sprinkles to support a wide array of initiatives. In this regard, Budget 2018 may be a prelude to Budget 2019—the election budget. Keep constituents happy. The large allocations are intended to address important issues with programming for Indigenous peoples, veterans, science and the environment. It is spending with the objective to boost the quality of lives for people over the long run.

Scott Clark, a former deputy minister of Finance, developed a simple framework to assess the credibility of fiscal policy. Clark made the case that credible fiscal policy must be realistic, responsible, prudent and transparent. By these yardsticks, Budget 2018 fiscal policy gets a passing grade but falls well short of a clean bill of health.

Do the Liberals have a realistic fiscal policy? Morneau will make the case that the economic assumptions underlying the forecast are an average of the private sector forecasts, so that it is an inherently balanced view. Others may quibble that this is a goldilocks scenario. Projected inflation rates remain modest despite the Canadian and U.S. economies operating at or above potential. Short and long interest rates would rise only 100 basis points over the next five years. This is optimistic.

Budget 2018 weighs in at a hefty 370 pages yet there is only one page on upside and downside economic risks. There is really no analysis on how the federal fiscal framework would be impacted by these risks other than the government’s contention that they have a balanced view.

Do the Liberals have a responsible fiscal policy? Canada does not have any hard fiscal targets on deficits or spending, unlike many other OECD countries. The Liberals remain committed to keeping the debt-to-GDP ratio below levels around the 2015 election. Let’s be frank, any target that would allow an increase in the stock of debt by $115 billion (i.e., a 19 per cent increase) and claim to be on track is a weak target.

Rising debt does have consequences for fiscal planning. The fastest growing spending component in Budget 2018 is now interest on the public debt (Table 2). Over the next five years, interest on the public debt is expected to rise by almost 36 per cent—more than twice the cumulative growth in program spending (up about 15 per cent).

Do the Liberals have a prudent fiscal policy? The government does have a small contingency reserve of $3 billion per year which would provide a cushion for a negative shock to GDP roughly equivalent to about 1 per cent of nominal GDP. This is a useful adjustment to the average private sector forecast but would not likely be able to offset the potential impact of negative risks briefly highlighted by the government related to NAFTA negotiations or a shock to housing markets.

Do the Liberals have a transparent fiscal policy? No.

Budget 2018 was disappointing even though some new transparency measures were added to help bridge the gaps between the budget and the estimates (i.e., how spending is approved by Parliament). The source of funds for the $21.5 billion in new budget initiatives is not identified other than parliamentarians and Canadians are told there are savings to be found in direct program spending.

Nearly 70 per cent of direct program spending is referred to as operational expenditures. Budget 2018 says that these expenditures will essentially remain flat over the next five years. They grew 11.1 per cent in 2017-18 (Table 2). What is the plan to constrain operational expenditures? No plan is provided. How do parliamentarians hold the government to account when they do not know where the savings are to be found? They cannot.

It is a fair bet that voters are going to have a hard time in the 2019 federal election campaign assessing whether the Liberal government fiscal policy has achieved a primary objective of strengthening and growing the middle class. Every budget and fiscal update since 2015 has included the ‘middle class’ in its title. The Liberal government mandate tracker features new initiatives it claims will help middle class fortunes. Yet, the Liberal government has refused to define the middle class in any way that would be useful to measure progress.

It is a fair bet that voters are going to have a hard time in the 2019 federal election campaign assessing whether the Liberal government fiscal policy has achieved a primary objective of strengthening and growing the middle class. Every budget and fiscal update since 2015 has included the ‘middle class’ in its title. The Liberal government mandate tracker features new initiatives it claims will help middle class fortunes. Yet, the Liberal government has refused to define the middle class in any way that would be useful to measure progress.

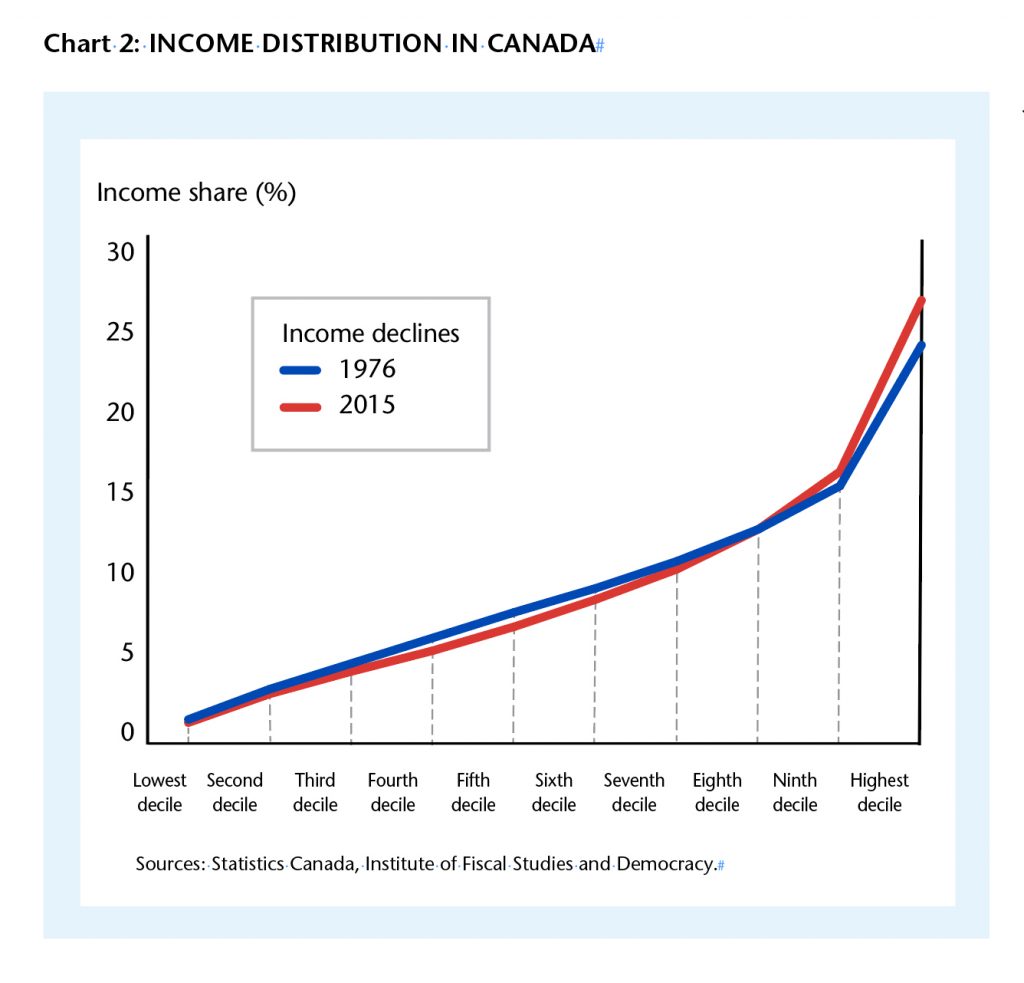

Chart 2 illustrates that there has not been fundamental change in income distribution (on an after-tax basis) since the mid 1970s in Canada. It takes a lot to move this distribution. While growing inequality may become a critical issue in the years ahead with accelerated change in technology, realizing gains in strengthening the middle class as seen by changes in income (or net wealth), distribution is a longer-term exercise.

Morneau should take a victory lap with the tabling of Budget 2018. “Give credit to whom credit is due”. The economy has come a long way since 2015.

Do we have credible and accountable fiscal policy that will help the country steer through economic and fiscal risks in the years ahead? That is, of course, an open question. Stephen Harper worked hard to get to budget balance in 2015. A fiscal policy that promoted austerity in the face of an oil price shock took the heat out of the economy and may have cost the Conservatives the election.

Janet Yellen, the former U.S. Federal Reserve chair, famously said “economic expansions don’t die of old age.” The current economic expansion is getting long in the tooth. Risks are building. Markets are getting jittery about the significant fiscal stimulus planned for the U.S. economy. Fears of global protectionism and a trade shock are increasing. At the same time as these international risks build, our domestic risks related to household debt outpacing income growth and high housing prices in major economic centres continues.

Fiscal policy may yet again become an election issue in 2019.

Kevin Page, former Parliamentary Budget Officer, is President of the Institute for Fiscal Studies and Democracy at University of Ottawa. Salma Mohamed is a student at U of O.

kevin.page@ifsd.ca